Q1 2024 SME Finance Trends: A Bright Start Amid Cautious Optimism

The first quarter of 2024 has shown promising signs for small and medium-sized enterprises (SMEs) in the UK, with an encouraging rebound in finance demand and economic activity. According to UK Finance’s Business Finance Review 2024 Q1, the financial landscape for SMEs is evolving, reflecting a cautiously optimistic economic environment. Here's a closer look at the key trends and insights from the report.

Economic Recovery and Business Confidence

After experiencing a brief recession in late 2023, the UK economy demonstrated a stronger-than-anticipated recovery in early 2024. GDP grew by 0.6% in Q1, driven by a strong performance in both the manufacturing and services sectors. Notably, services output expanded for the first time in a year, with consumer-facing industries like retail showing significant improvement. However, the construction sector faced continued challenges, with output declining for the second consecutive quarter due to higher borrowing costs and price pressures.

Business surveys, such as the Federation of Small Businesses' Small Business Index, indicate rising optimism and revenue expectations among SMEs. This positive sentiment is supported by increased investment over the past six months, suggesting a gradual improvement in business confidence.

SME Lending Trends

The first quarter of 2024 marked a significant increase in gross lending to SMEs, with a 15% rise compared to the previous quarter, amounting to over £4 billion. This represents an 8% increase from the same period last year and matches the highest lending figure since Q4 2022.

Figure 1: Gross Lending to SMEs, £billion – Source: UK Finance

--360.png)

Business activity is recovering after two challenging years, with easing cost pressures and improving confidence driving a higher demand for finance. However, the high interest rate environment and uncertainty about future Bank Rate changes are causing some businesses to adopt a cautious approach.

Lending growth is varied across regions and sectors. The East Midlands, London, and the North East saw significant increases, while Scotland remained stable, while Wales and the West Midlands experienced slight declines. Sector-wise, education, real estate, professional services, and construction saw the largest increases. Conversely, lending to accommodation and food services declined, and manufacturing experienced a notable 20% drop compared to Q4 2023.

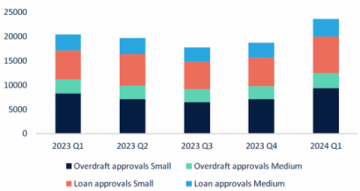

New Finance Approvals

In Q1 2024, finance approvals grew significantly, increasing by 27% compared to the previous quarter, with the value of approved finance rising by 10%. This marks the highest number of approvals for new or increased loans and overdrafts since Q1 2022.

Both loans and overdrafts experienced positive trends, with overdrafts up 27% and loans up 26%. Small companies saw a 30% rise in approvals, while medium-sized companies saw a 17% increase. Sectors such as construction, transport, storage, and communications saw the largest gains.

This consistent growth across sizes, sectors, and types of finance suggests a return to normal financing conditions, though sustained growth is needed amid economic and political uncertainties.

Figure 2: Finance Approvals, Number - Source: UK Finance

Utilisation of Existing Facilities

Overdraft utilisation increased to just over 50% by the end of Q1 2024, the highest since the pandemic. This rise was seen across most sectors, with accommodation and food services, as well as recreational and personal services, leading due to cost pressures.

Despite recent increases, utilisation rates remain below pre-pandemic levels by about seven percent. As cost pressures ease, utilisation rates may stabilise lower, allowing SMEs to focus more on business development.

Figure 3: Overdraft Utilisation by Sector, % Rate - Source: UK Finance

UK Finance’s data showed invoice finance and asset-based lending (IF/ABL) remained flexible in Q1 2024. Despite a decline in client sales, the advances drawn down stayed steady, with IF/ABL utilization at 61%, consistent with 2023 averages. This indicates ongoing flexibility within existing financial arrangements.

SME Deposits

In early 2024, SMEs increased their use of overdrafts and significantly reduced cash deposits. By the end of Q1, deposits were 4.5% lower than the previous quarter, marking the fastest decline since the pandemic. Deposits fell from over £270 billion in Q4 2021 to £223 billion, with sight and time deposits down 6% and 3%, respectively.

Figure 4: SME Deposits, £billion – Source: UK Finance

The cash reserves accumulated in 2020 and 2021 have helped firms manage cost spikes and weak demand, although unevenly across SMEs. Despite the decline, deposits remain over 10% higher than pre-pandemic levels.

Deposit reductions were widespread, with accommodation and food services seeing the largest decline, over 10%, followed by agriculture, down 8%. However, all sectors still have deposit levels above pre-pandemic levels, indicating that many SMEs retain internal resources to handle unforeseen challenges.

Finance Repayments

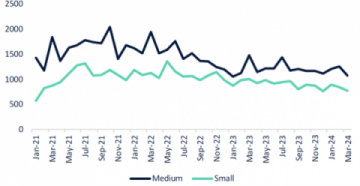

SME finance repayments have remained stable over the past year, with slight declines in recent quarters, consistent across small and medium-sized businesses.

Modest declines in repayments are expected. Government data shows continued progress on repayments of government-backed loans, with 12.5% of Bounce Back Loans fully repaid and 60% on schedule. Consequently, fixed-rate borrowing is at its lowest since May 2020, with little increase in variable rate borrowing due to low new borrowing levels.

Sector differences in repayments exist, with manufacturers and transport, storage, and communications SMEs repaying more quickly, while accommodation and food services have seen increased repayments, especially in Q1 2024.

Figure 5: Repayments, £million - Source: UK Finance

Outlook for SME Finance

The positive trends in Q1 2024 suggest that SMEs are beginning to emerge from the challenges of the past two years with renewed confidence and a cautious optimism for the future. The consistent growth in finance approvals, increased lending, and improving economic conditions paint a hopeful picture for the remainder of 2024. However, the ongoing cost pressures and political uncertainties, including a forthcoming general election, highlight the need for sustained vigilance and strategic planning by SMEs and financial institutions alike.

In summary, the first quarter of 2024 has set a promising tone for SME finance in the UK. With signs of economic recovery and increasing business confidence, SMEs are poised to capitalise on new opportunities while navigating the challenges that lie ahead.

The Importance of Seeking Advice

The promising financial trends of Q1 2024 highlight the need for strategic financial planning for SMEs. With opportunities and challenges on the horizon, seeking advice from a commercial finance consultant is crucial. Our experienced consultants are ready to assist you with personalised guidance every step of the way. For an initial consultation, speak with our experts or call us at 01628 564631.

Take the first step towards securing your business finance today.

The information contained within was correct at the time of publication but is subject to change.

Source: UK Finance | Business Finance Review 2024 Q1